08 Feb An Emerging Seller’s Market, Reports BizBuySell

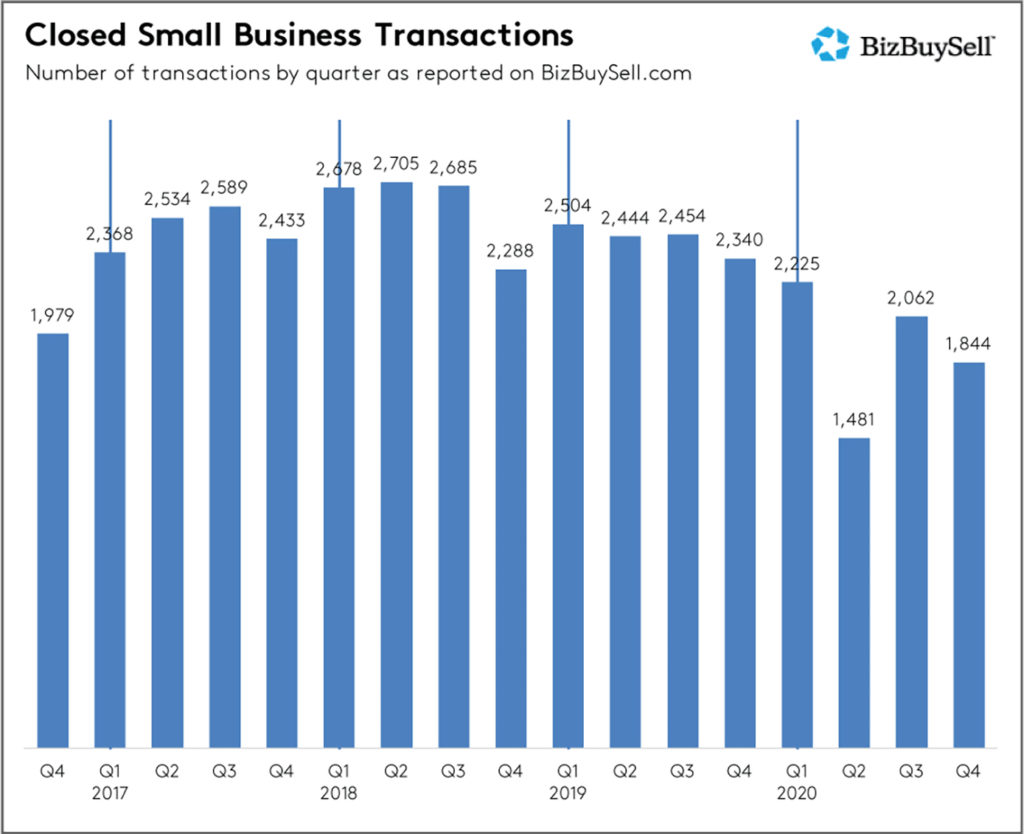

The pandemic upended expectations for both business buyers and sellers in 2020, but not necessarily in negative ways. The past year saw one of the steepest year-over-year declines in Main Street business sales, according to BizBuySell’s Insight Report released January 21, 2021. The quarterly report, which tracks and analyzes business-for-sale transactions, stated that 7,612 business transactions closed, a 22% drop from 2019.

Looking forward, the news is more promising. Pent-up demand combined with the Fed’s aggressive stimulus measures are anticipated to bolster buyer activity in 2021. Under the recently passed CARES Act, the SBA will pay up to six months of Principle & Interest, and as much as 11 months for certain hard-hit business sectors, on all SBA 7(a) loans that close by the end of September.

This is a huge incentive and more or less a repeat of the CARES Act loan forgiveness program that faded out at the end of Q3. This unprecedented financing opportunity had a visible impact, with sales peaking that quarter.

Even unpacking the headline, 2020 paints a mixed picture. As buyers flocked to businesses that weathered the Covid storm, median prices increased 12% to $279,950. Revenue and cash flow reached records highs.

What emerged was a Seller’s market for pandemic-proof businesses. The Report states:

“While many businesses were hit hard by the pandemic, some sectors instead found favorable conditions. The economic disruption caused by the virus changed consumer behavior, and ‘pandemic-resistant’ businesses, such as delivery and logistics companies, fast-casual restaurants, e-commerce websites, and manufacturers of certain goods saw revenue soar in 2020.”

The reality is that low supply and high demand is putting a higher premium on each dollar earned when compared to years past. One indicator of this is that the average multiple of revenue increased 6.7% and the average multiple of cash flow jumped 5.7% compared to the previous year.

Now as we move steadily in 2021, will we see a repeat of 2020’s trends? All evidence points to an affirmative, but there’s a strong opportunity that we’ll actually see a broader impact.

Record layoffs are helping fuel this demand. With unemployment reaching numbers not seen since the second world war, corporate refugees represented 21% of “the newly unemployed” according to BizBuySell’s survey, while another 36% reported being unhappy with their job. Other contributing factors on the buyer’s side included existing business owners looking to expand and Baby Boomers looking for new acquisitions.

Whereas 2020 saw a demand for Covid-proof businesses, distinct differences in this year’s CARES financing incentives may have more sweeping repercussions. As noted above, those sectors that have taken it on the chin – including passenger charter businesses, gyms, restaurants, skin and beauty care businesses, and a number of others – will receive up to 11 months of paid Principle and Interest and the waiving of the SBA guaranty fee, thanks to the SBA. This is not a deferment, but the SBA will actually cover these P&I costs.

What is the catch? Market conditions are converging to make a robust Seller’s market. To take advantage of these favorable conditions, it does not pay to delay. Just like in 2020, where the market saw a dip in Q4 after this program wrapped up, you only have so many months, or really weeks, to bring your business to market and position it for a fast, mutually beneficial sale.