21 Jun Small Business Sales Rebounding

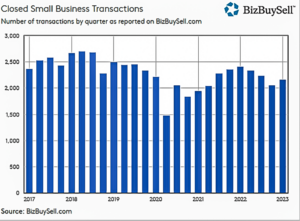

After a rocky end to 2022, this year kicked off with favorable market trends and signs that demand for acquiring small businesses is rebounding. BizBuySell, a leading online businesses-for-sale marketplace, recently found in its analysis of sales data and survey of business brokers around the country that a rise of 4.8% in the volume of small business acquisitions in Q1 2023 over Q4 2022 shows promise of a recovering market after three consecutive quarterly declines. In the first half of 2022, there was a noticeable growth in transactions, up 24% in Q1 and 14% in Q2. However, rising inflation and interest rates stalled the market and caused a 13% drop in Q4. According to BizBuySell’s Insight Report, transactions are still 10% below the previous year. However, median sale prices are up 1.4%, and 11% over the previous quarter. Additionally, businesses sold in Q1 2023 have reported a 6.7% rise in median revenue and a 2.8% rise in median cash flow, reaching their highest levels on record. This is indicative that as buyers and sellers are adjusting to current economic conditions, so are consumer spending patterns. SBA loan processing delays are also a factor behind the recent rise in deals closing since some closings were pushed to Q1.

BizBuySell also experienced a 27% increase over the previous year in monthly visits to its online marketplace of active listings. This has likely been caused by the uncertainties of the last couple years, which have led people to reevaluate what they want to do in their professional lives. This has inspired many people to look at purchasing a business so they can be in control of where they decide to put their money.

Burning Out and Retirement Top Seller’s Lists as Reasons to Exit

Listings have also risen in the new quarter, and as more and more small businesses hit the for-sale market, a common theme among sellers has become apparent. Many owners have stated their reasons for selling their business as retirement (44%) and burnout (30%). Around 28% of business-selling owners stated that they are speeding up their exit timelines, which has also contributed to the rise in deals closing sooner during Q1. After 2022, when the business world finally felt closer to what it was before the pandemic, many owners are finally feeling comfortable enough to look for a sale after giving their businesses the time to stabilize in efforts to get the highest possible value and return in a sale. In a survey among business sellers that questioned which macro-economic conditions were affecting their exit timeline, inflation, and recession were the top reasons (50%), while rising interest rates were second (46%), followed by financial concerns (42%), and hiring challenges (35%).

President of Sam Goldenberg and Associates, Michael Greene, says that the reasons for the recent surge in listings caused by retirement are “the delayed wave of baby boomers selling their businesses who were expected to retire at 65 a decade ago. Many decided to delay, are now in their seventies, and are ready to exit. Also, given the difficulties of running a business during Covid, [owners] have decided this is a good time to sell and retire.”

High Acquisition Costs Put Pressure on Business Values, Giving Buyers an Upper Hand in Negotiations

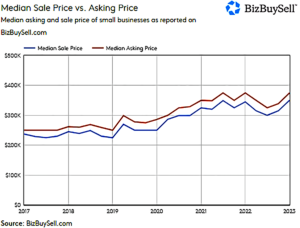

Buyers now have more leverage in negotiating lower prices as the Fed’s series of interest rate hikes have increased acquisition costs. This newest market trend has made high asking prices less tenable and encouraged sellers to be more open to price negotiations. During this time, the median sale price has risen 1.4% over the past year, however, the average revenue multiple declined 5.7% and the average cash flow multiple declined 3.9% according to BizBuySell. In its recent survey of business brokers, 42% believe that the current market favors buyers, while 29% believe it is balanced, and 17% believe it favors sellers. This current market presents a lot of opportunities to buyers who are looking to get the best value at a price that is favorable to them.

Higher Asking Prices Leading to More Days Spent on the Market

Although parties are more willing to negotiate on price, businesses with a price tag of $1 million or higher have seen an increase in average time spent on the market, going from a median of 200 days in 2022 Q4 to a median of 211 days in 2023 Q1. This is the third consecutive quarter where the median days spent on the market have risen for businesses listed over $1 million. These businesses have also seen a median cash flow of $560,473 alongside their 211 days on the market, compared to a $125,348 median cash flow and 176 median days spent on the market for businesses listed under $1 million. The higher-priced businesses have also averaged a .90 revenue multiple and 3.55 cash flow multiple, which is considerably higher than the multiples of businesses listed under $1 million, whose averages are .57 and 2.25 respectively.

Market Outlook for Summer of 2023

As we move into the summer of 2023, the small business market is expected to see some challenges imposed by rising interest rates and inflation. Q1’s favorable uptick provides hope that the market is adjusting to the current economic conditions. Hopefully, this trend will continue throughout the year as we distance ourselves further from the damages caused by the pandemic.

Demand is expected to remain high, as many people are starting to leave the corporate world and take charge of their own business and future. With so much uncertainty in the economy, the stock market’s erratic behavior, and real estate becoming risky, many people are unsure of where to put their money. This has made the business-for-sale market even more attractive since purchasing a proven business and devoting time to its success seems like a reliable place to invest one’s time and money among so much uncertainty. Even though we are seeing higher interest rates, BizBuySell reports that 38% of buyers still believe they can get a good value at a price that is reasonable or favorable, especially since there has been a recent trend of buyers being able to negotiate a better price. There also has been an influx of listings due to many owners being ready to retire and waiting to get their numbers up post-COVID to find the right time to sell their business. A high percentage of business brokers (42%) believe that despite all of the challenges, this market does in fact favor buyers, allowing a lot of potential for those who are looking to take over a business.

Read the BizBuySell’s full Q1 Insight Report.